Turkish Airlines to launch Istanbul-Yerevan flights

New round of Ukraine talks planned soon

Pakistan thanks Azerbaijan after Islamabad attack

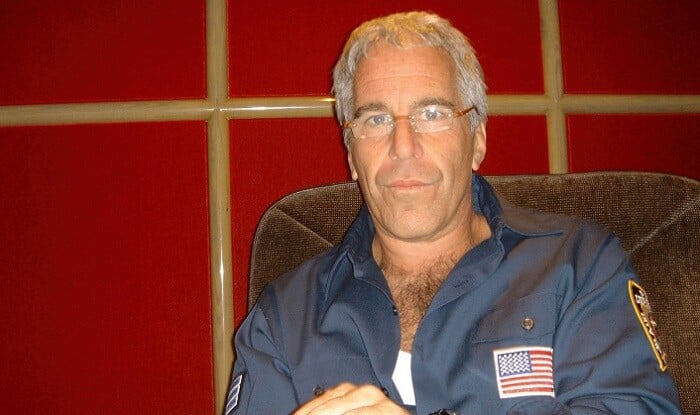

Epstein’s brother alleges Trump ordered his death

Lithuania protests Russian attacks

Ombudsman raises child safety concerns

Germany ready for talks with Russia on Ukraine war

Russia open to talks on “Trump Road” project

Lukashenko cautions on e-cigarette restrictions

US: New nuclear talks will take time

Azerbaijan summons Russian envoy

Hungarian official will visit Azerbaijan

Iran, US nuclear talks in Oman were a good start

Defense ministers of Azerbaijan and Iran held meeting – Video

Deal signed to transfer Syrian prisoners in Lebanon

Canada and France opening consulates in Greenland

Trump unveils TrumpRx discount drug site

Ukraine security talks in Abu Dhabi will be continued

4.9-magnitude earthquake hits eastern Turkiye

Azerbaijan raises concern over 'Artsakh' music at Olympics

Azerbaijan expresses condolences over Islamabad mosque attack

Lavrov accuses Kyiv of assassination attempt on top general

US-Iran talks begin in Oman

Russia updates Ukrainian losses on day 1444

Russia captures Popovka in Sumy region

Powerful people fired because of ties to Epstein

Explosion rocks mosque in Islamabad, 31 dead - Video

Israeli president visits Australia after Bondi beach attack