The conflict between Israel and Iran has disrupted economic stability in the Gulf countries.

Axar.az reports that international energy expert Mamdouh Salameh stated this.

“Although the temporary rise in oil prices during the attacks brought short-term gains to Gulf countries, revenues began to decline again after the ceasefire. These countries’ budgets are mainly based on Brent oil prices ranging between $85–95. However, current prices are below that level, and countries like Saudi Arabia are especially struggling to cover their expenditures,” the expert said.

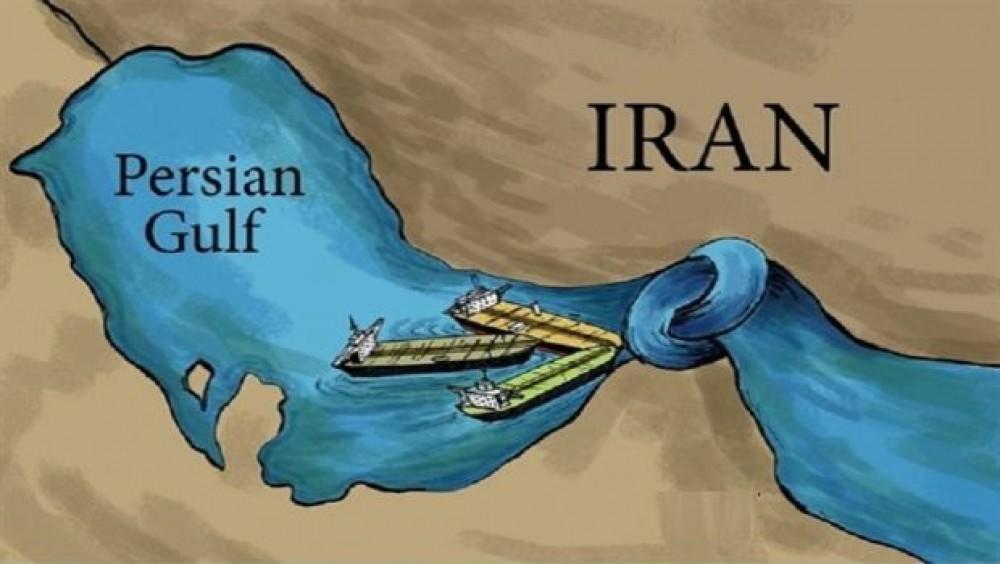

Salameh also noted that Gulf countries are heavily dependent on the Chinese market for oil exports and that reliance on the Strait of Hormuz will likely continue for decades—if not permanently:

“While Saudi Arabia has an alternative pipeline to the Yanbu port and the UAE to Fujairah, these options are not fully sufficient if the Strait of Hormuz were to be closed.”

Nayel Jaber, chief economist at VT Markets, added that the Israel-Iran war has seriously impacted the Gulf region, particularly its financial markets:

“If the Strait of Hormuz is closed, countries like Iran, Kuwait, Iraq, and Qatar would suffer the most in terms of oil exports.”