Iran slams US-Israel nuclear attacks as NPT violation

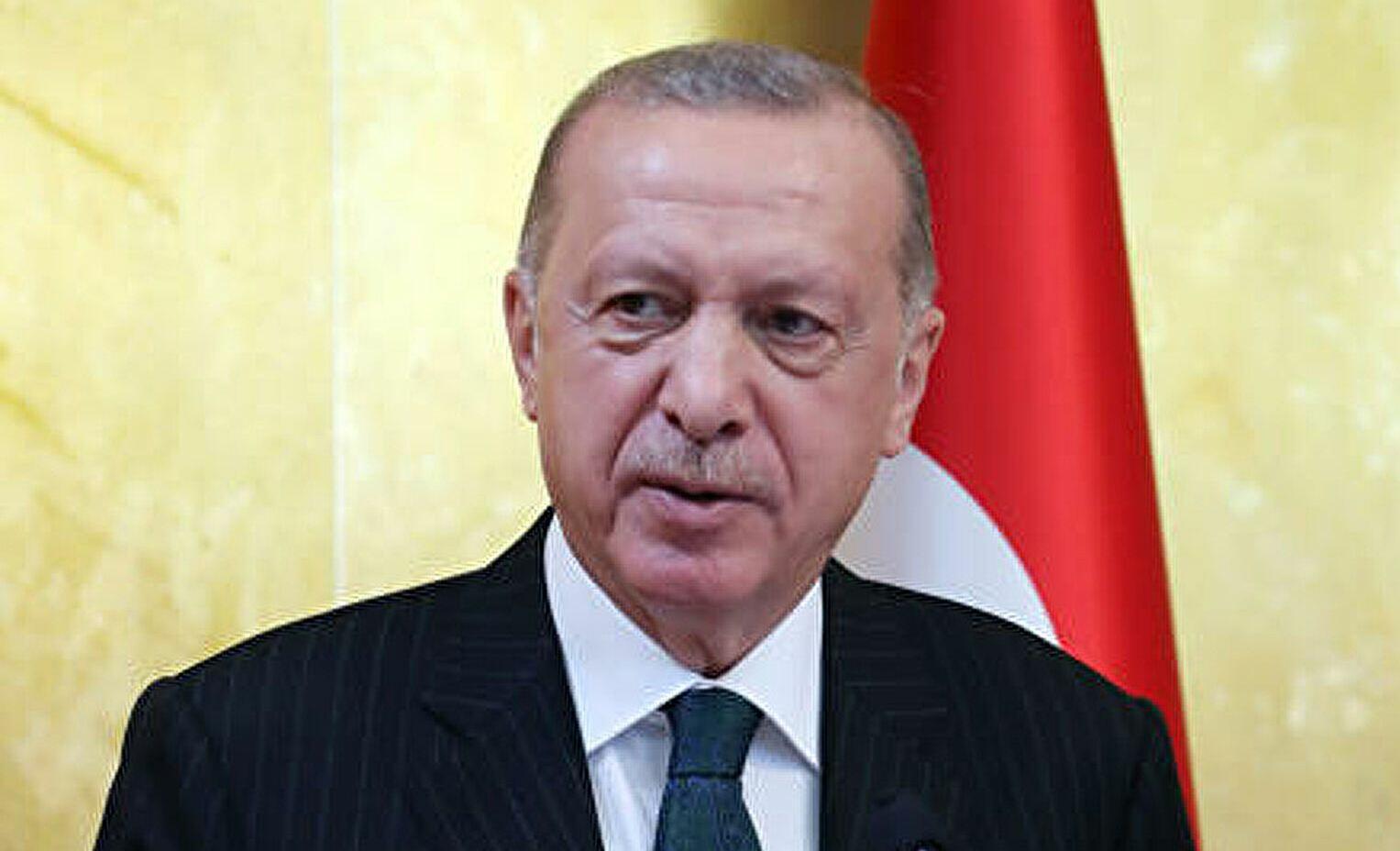

ECO Summit in Khankendi ends with key communiqué

Trump declares emergency in flood-hit Texas

.jpg)

Azerbaijani Defense Minister offers condolences to Turkiye

Mass flight cancellations at Sheremetyevo Airport

Israeli delegation in Doha for indirect talks

Putin: Entire Russia backs war effort

Dagestan head concerned over Russia-Azerbaijan tensions

5 Turkish soldiers die from methane gas exposure

Lavrov arrives in Rio de Janeiro for BRICS Summit

Putin: Russia will achieve freedom and justice

Pakistani speaker visits Azerbaijan

Musk registers new America Party with FEC

Ukraine, allies expand long-range arms production

Porto names Farioli as new head coach

Russia reports updated Ukrainian losses

Russian delegation to visit Baku

Two Russian airports closed

Moscow-St. Petersburg air traffic disrupted

Azerbaijan extends condolences over deadly Texas floods

Putin: US-Russia ties historically positive

Zelensky: Hundreds freed in prisoner swaps

The weather forecast has been announced

Hezbollah rejects surrender amid threats

Elon Musk criticizes Donald Trump

Uzbekistan will buy J-10 fighter jets from China

The US Embassy in Yerevan issues a visa warning

Smart hydrogel developed to heal chronic wounds faster